Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

When you look at our world amidst the COVID-19 pandemic today, you will notice that it’s not just the people who are getting sick, but there is also something that’s getting slightly sick and perhaps even on life support. Something is seriously wrong with our economic system!

Over this article, I intend to give you something to think about over during lockdown. Although economics is a vast subject, I hope to provide you with a fundamental understanding of the problems that have marred our economic system, inflation, greed, and the battle between paper currency and gold.

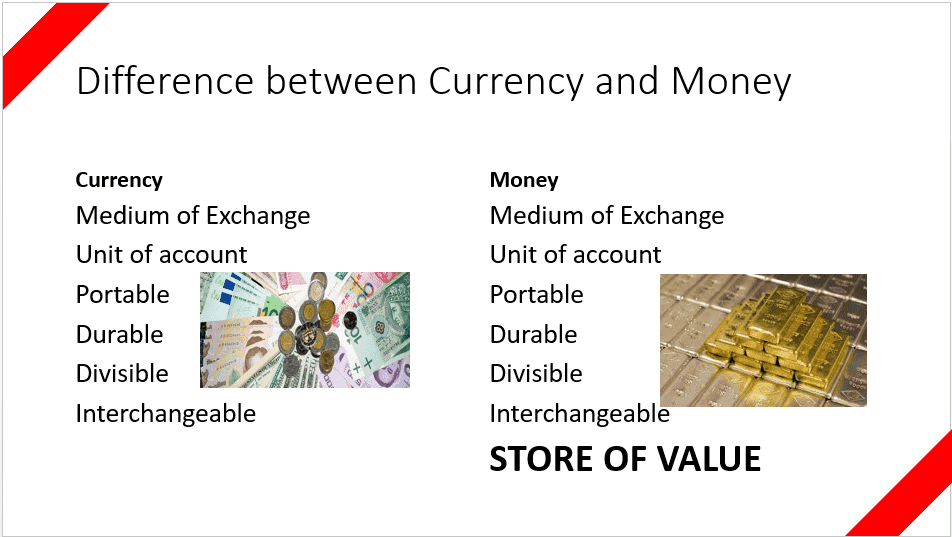

Notice the difference? The paper that we carry today in our pockets is universally misunderstood as money when it is, in fact, currency NOT money. Currency does not store value, and it never has! For those of you who think otherwise, I urge you to ask your parents what their school fees were, their house rents, costs of books—feeling the effects on inflation yet?

This is made worse by the reality of today’s paper currency, which allows central banks to print paper currency, which they do with pleasure all the time. When a central bank prints money, it must be backed by something in the treasury by, for instance, gold or other assets. Why should it? I ask my reader, do you think that paper in your hands is worth $100, 100 Rupees, or £100. No, it isn’t. The Gold Standard or the Classical Gold Standard pegged paper currency to a certain amount of gold in national treasury and US treasury, respectively. This meant that you could walk into the central bank of your country with your paper currency and exchange it for the same amount of gold or US dollars to which it was pegged. Do you imagine converting your currency or dollar to gold this way today? I don’t think so.

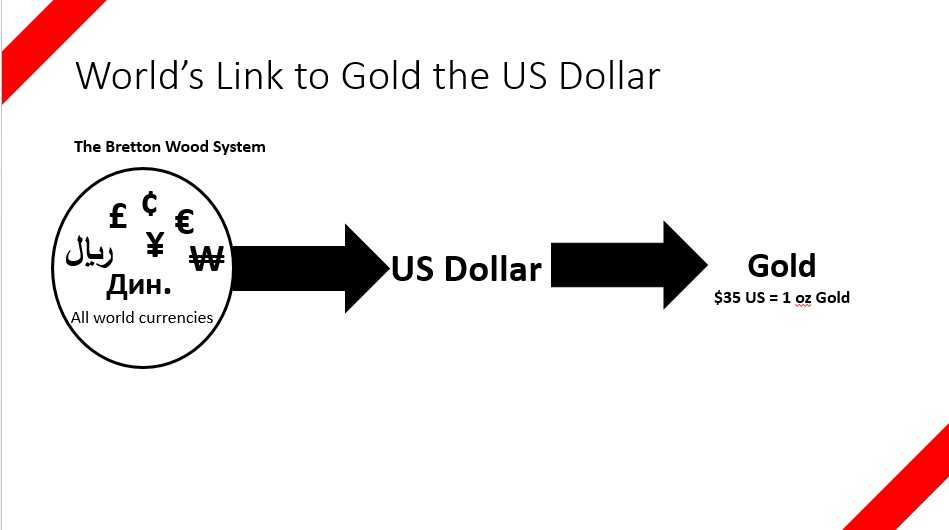

Bretton-Woods system established at the end of World War 2, pegged all world currencies to the US dollar, which was in turn pegged to gold at $35 per ounce. Although the system had its limitations, it was still constrained by the limited abundance of gold in nature, and thus kept in check.

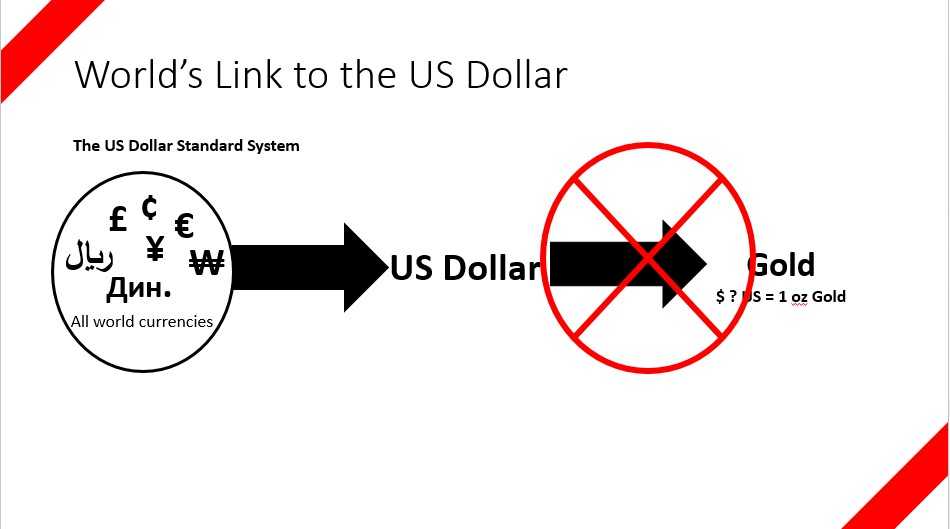

The world has been off gold for close to half a century when US President Richard Nixon broke the last ties of the US dollar to gold thus ending the Bretton Woods System in August 1971 and since it’s getting complicated, allow me to make a simple presentation.

When the dollar severed its ties to gold, so did the rest of the world (courtesy of the dollar). Ladies and gentlemen, welcome to the new world of fiat currency; a currency that has value solely because people choose to believes in the “good faith” of the government.

The Greatest Bread and Circus of all times

By now, you may be wondering why didn’t the rest of the world do anything? Or more importantly, HOW does this affect us?

The rest of the world didn’t do anything because gold is limited money and paper currency is easy to print! The ruling party of your government wants to win elections? No problem, write a capital, and start mega public works projects; monorail, bridges, power plants, airports who do you think finances them?

The treasury sells bonds, central banks buy those bonds with money they print, and now the public has to pay the principal amount back to the central bank with interest on money that was created out of thin air. The government and the society are happy for the new infrastructure, and bankers are so glad for their timely interests. This folks is the most magnificent Bread and Circus show ever to have been played, and it is pretty scary as happening on a global scale!

Why would any government want to revert to the gold standard when they can scam you out of your life saving just by printing more currency? Each Dollar, Rupee, or Pound created dilutes the purchasing power of the previously existing paper currency. The more the money is in supply, the less is the value and the higher is its inflation; which is why you keep hearing about the good old cheap times from your older relatives.

But the economy of the entire world is booming; never before has the economy of the entire human civilization grown at such an astounding pace. There are increasing levels of public investment, private investment, newer, efficient businesses come into existence by the day forcing older, ineffiecient ones out of the economic race and financial markets are reaching record heights. This skewed system of Keynesian economics is the reason we enjoy the growth at a cost of ever increasing national and public debt; a debt that we can never repay because to return every last rupee with interest; we will need to borrow it into existence.

This problem is not just unique to Pakistan but also to the worlds biggest economies including the United States, which, to return every Dollar, has to borrow it from the Federal Reserve into existence. In addition to this, P36akistan also has a problem of foreign debt that has to be paid in dollars. No nation on Earth is debt-free. Our entire world is built on this beautiful paper lie.

Gold is limited in nature, and we cannot create it in laboratories, even the governments who often have a history of cheating people. History has shown itself over and over again NO FIAT CURRENCY IN RECORDED HISTORY HAS EVER SURVIVED. Every last of them have gone extinct, disappeared into our history books of failures.

Only precious metals such as Gold and silver are true stores of value, and everything besides these is a fallacy. Throughout history, there have been many forms of money cows, goats, wool, glass, Gold, etc. all served as a source of economic dealings.

Let’s take the cow as an example for money, and a severe disease kills cows would rapidly increase the price value of the cow due to shortage. In contrast, the absence of predators might increase their numbers and reduce their price value, making it currency, not money.

On the other hand, we can only mine the Gold from the earth in limited amounts. If a country has a lot of Gold, it will import a lot, which will diminish its gold reserves. As Gold runs down, the economic recession will cause the price of goods to fall, which makes its products cheaper. Cheap goods result in more exports and gold inflow to replenish the gold reserves, and this pattern continues. Our model of constant economic growth is unsustainable!

We all suffer from a “this time syndrome” (words of Michael Maloney), where we believe we have tamed the economic monster when we repeat the same mistakes and hope for a different outcome before eventually reverting to Gold. My only fear this time is that this time when it will all come crashing down, its impact will be felt around the globe.

The Bigger Picture

We established Gold Standard for ease during cross border trades. If a German farmer wishes to sell wheat to an Italian buyer, what use would the Italian currency be to him in Germany? Unless the German treasury and Italian treasury pegged their currency to gold? That way, the German farmer could change Italian Lira to Deutsche Mark and use it to pay his workers, perhaps. Both coins are pegged to gold, and both governments assure the other they have gold in their vaults equal to the amount of currency they have exchanged. Something was backing that currency.

Exchange rates were developed to facilitate smooth trade to the extent that now we have globalized supply chains that are under threat due to the current pandemic. With nearly all central banks printing more currency to get through the crisis, we risk inflation (or even hyperinflation). When the crisis ends, we will have much more money in this world before we entered the pandemic. Nothing will be the same as before, and living will become much more expensive.

Gold Standard was established for ease of cross border trade. If a German farmer wishes to sell wheat to an Italian buyer, what use would the Italian currency be to him in Germany? Unless the German treasury and Italian treasury pegged their currency to gold?

That way the German farmer could change Italian Lira to Deutsche Mark and use it to perhaps pay his workers. Both currencies are pegged to gold, both governments assure the other they have gold in their vaults equal to the amount of currency they have exchanged. There was something backing that currency.

Exchange rates were developed to facilitate easy trade to an extent that now we have globalized supply chains. Supply chains which are threatened due to the current pandemic. With nearly all central banks printing more currency to get through the crisis, we risk inflation (or even hyperinflation).

When the crisis will end, we will have much more currency in this world before we entered the pandemic. Nothing will be the same as before and living as usual will become much more expensive for the common man. You and I.

I conclude my article with the wise words that sparked my interest in economics

“Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves.”― Norm Franz, Money & Wealth in the New Millennium: A Prophetic Guide to the New World Economic Order

Credit: Most references were taken from and influenced by Guide to investing in Gold and Silver by Michael Maloney